can you owe money in stocks on robinhood

This happens because Robinhood does not offer a negative balance protection. If you decided to Exercise your Buy.

Identity Theft What I Learned After Somebody Used My Ssn To Try To Trade Stocks On Robinhood

The margin interest rate charged by Robinhood Financial is 25 as of December 21 2020.

. You are the product in this case. Can you owe money on a stock. The rate might change at any time and at Robinhood Financials discretion.

Where the current market price enters your bought strike price. Paying Taxes on Robinhood Stocks Only investments youve sold are taxable so you wont pay taxes on investments you held throughout the year. You may have to pony up the money to buy the shares.

So if you wanted to buy a stock for 100 you could put 50 of your own money in and borrow 50 from your broker. Can you owe money to Robinhood. Look at the bright side.

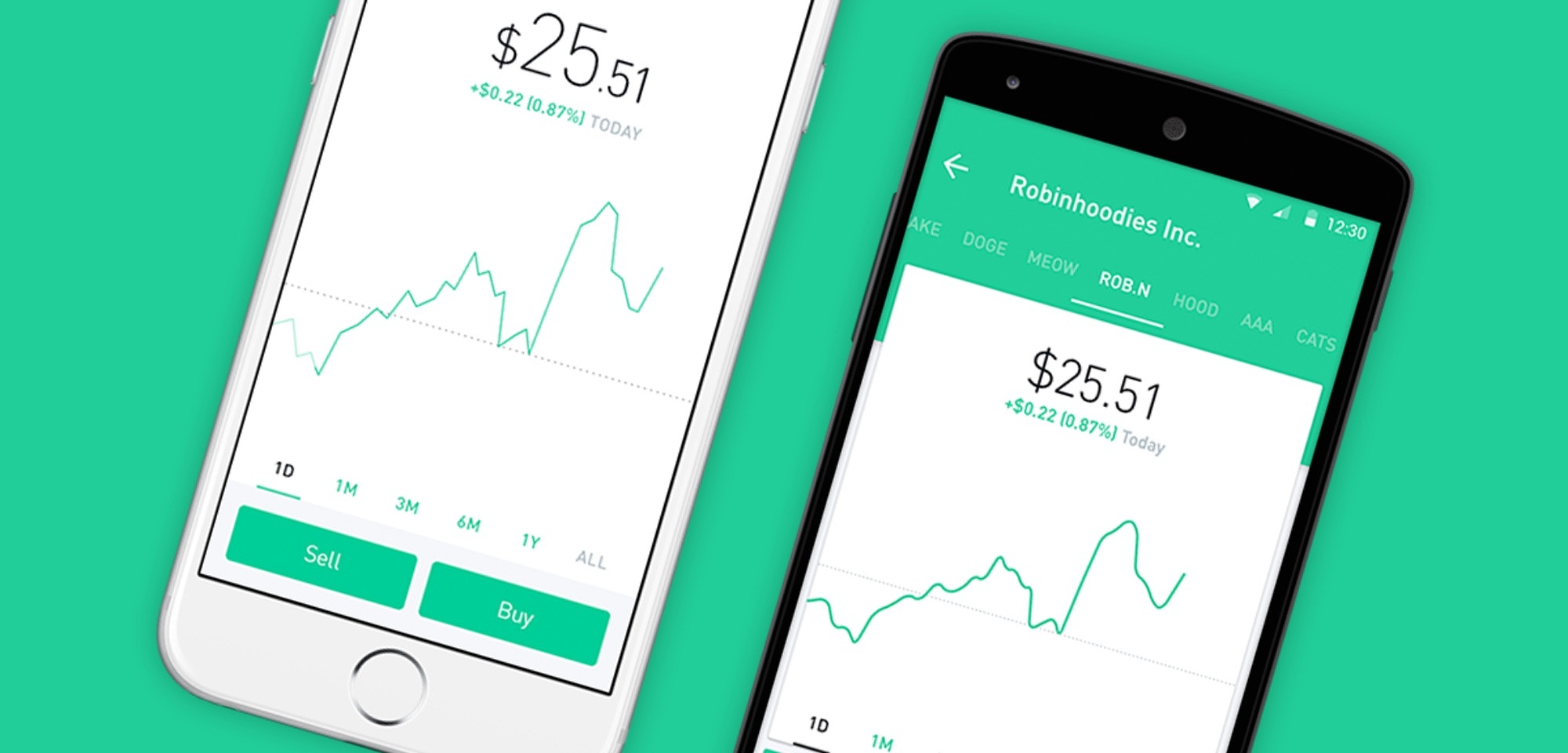

During the COVID-19 pandemic retail investors took a shine to Robinhood a no-fee and simple trading platform that was easily accessible from your smartphone. If a company goes bankrupt its stock can conceivably be worthless but no worse than that. If you trade a cash account the most you can lose is 100 and go to zero.

You only owe taxes on a stock after you sell it. However while this cannot happen the book value can go negative and you can lose more money than you invested or end up in debt. You can likely get mod status over at rwallstreetbets.

Your trading information along with everyone else on Robinhood is getting sold. You cannot have negative money in stocks because even if the price of your stocks fluctuates or falls drastically it cannot attain a value less than zero. Can you owe money on a stock.

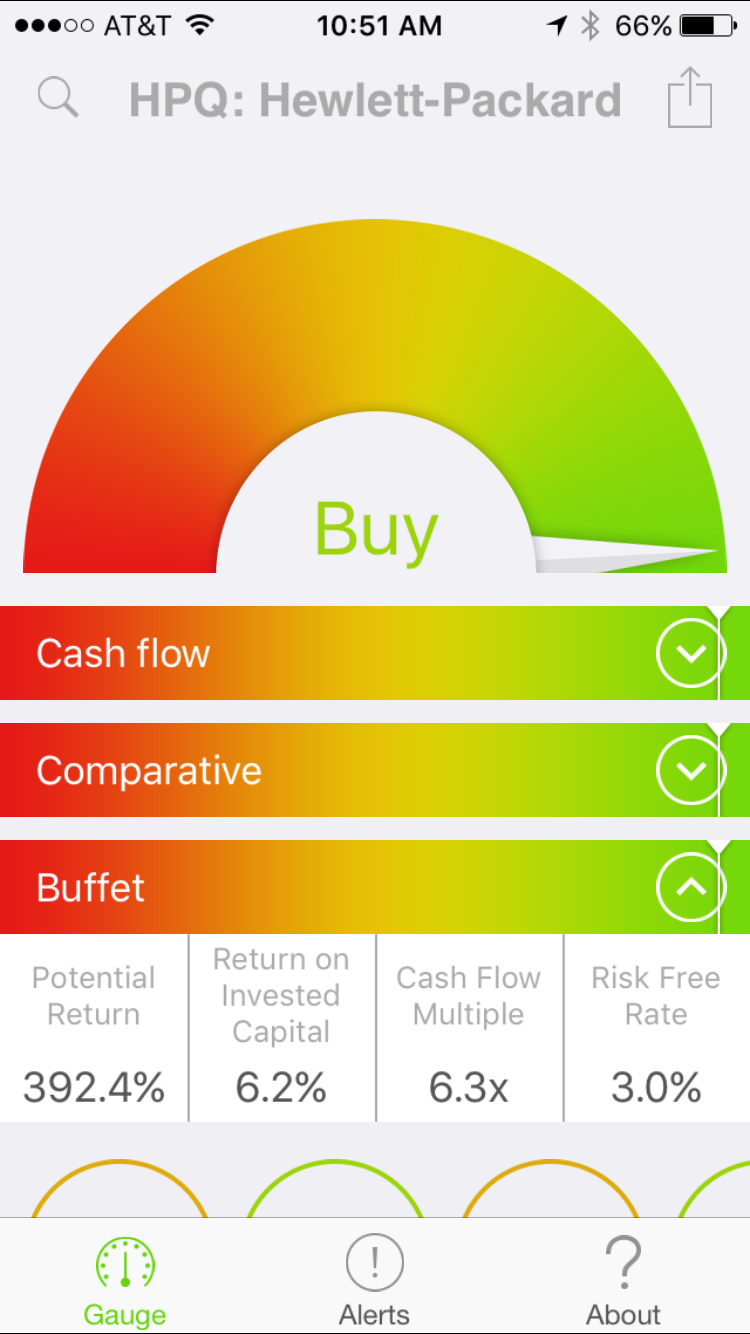

Answer 1 of 8. The platform lets you trade stocks and options for 0 each. Is my money safe in Robinhood.

If you trade a margin account you can lose more money than is in your account and youll have a negative balance and owe them the difference. Keep in mind though that interest will immediately start accruing on your loan. Your funds on Robinhood are protected up to 500000 for securities and 250000 for cash claims because they are a member of the SIPC.

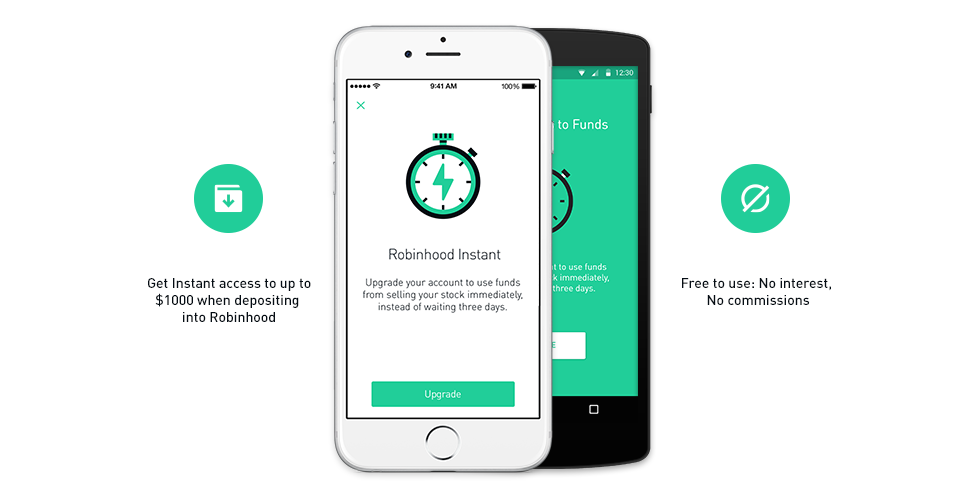

With Robinhood Gold you can get even bigger Instant Depositsup to 50000 depending on your account balance and status. A company can lose all its value which will likely translate into a declining stock price. My 151 call got exercised and I got assigned the.

It was a 1505151 call credit spread. You do have to ask yourself if the platform is free then how do they make money. On this page we have gathered for you the most accurate and comprehensive information that will fully answer the question.

Can you owe money in stocks. Your funds on Robinhood are protected up to 500000 for securities and 250000 for cash claims because they are a member of the SIPC. They can be worth something or nothing.

If you acquired the stocks with your own income you will not owe your brokeragent any money if the value of the equities drops. There are no annual fees or inactivity ACH transfer fees. Can you go negative on Robinhood.

Stocks cant go negative. So you might spend 1055 on a burrito bowl with your Cash Card and Robinhood will round the payment up to 11 and use the extra 045 to. Losing money in the stock market happens quite often.

Can You Owe Money to Robinhood. With that said its important to know what you can do to prevent having to owe money to Robinhood or any online broker you use. That is the most common way to hit a negative balance.

If you had a bad year and your losses outstrip your gains you can deduct up to 3000 from your taxable income as long as you sell any duds by the end of the year. They cant be worth less than something. Furthermore Robinhood is a securities brokerage and as such securities brokerages are regulated by the Securities and Exchange Commission SEC.

YES Robinhood is absolutely safe. That means if you see an opportunity in the market you can use your money right away instead of waiting up to five business days for your funds to settle. YESRobinhood is absolutely safe.

Which then lead to number 2 which is your decision. Obviously you can a negative balance on Robinhood if you are trading on margin. Whats the most money you can have in Robinhood.

That is the most common way to hit a negative balance. What happens when you sell a share on Robinhood. OP 3 yr.

Wait for QQQ to go up and sell it or you can turn around and sell them immediately. Looking for an answer to the question. But you have to pay tax as the money is earned like everyone else whether you withdraw the funds or not.

Unless there are 2 conditions being met. Right now youve taken out a. Do you owe money if stock goes negative.

Which is unlike any other platform. Yes you can lose any amount of money invested in stocks. 10 Ways To Invest 1000 And Start Growing Your Portfolio Try day-trading.

If you fail to meet your minimums Robinhood Financial may be forced to sell some or all of your securities with or without your prior approval. Your funds on Robinhood are protected up to 500000 for securities and 250000 for cash claims because they are a member of the SIPC. Answer 1 of 32.

If the value of their shares falls because their broker loaned them money to buy. Understand that a stocks value can never fall below zero so even if a firm goes bankrupt youll never owe your broker money. No like all other trading platforms you dont have to pay taxes to withdraw money from Robinhood.

Which is unlike any other platform. I cant find anything online I believe this is a rare case since XIV dropped 90 during after hours trading and they only had 60 margin maintenance required for it. Can you owe money on a stock.

You wont generally owe money to your brokerage if your stocks bonds ETFs mutual funds or other assets lose value. You can hold a stock for 40 years and never pay taxes on it until you decide to let it go. While stock prices fluctuate to reflect changing market assessments of the value of a company a stocks price can never go below zero so an investor cannot actually owe money due to a decline in stock price.

But you can have an account go negative and lose more than you invest if youre buying stocks on margin instead of buying with. Furthermore Robinhood is a securities brokerage and as such securities brokerages are regulated by the Securities and Exchange Commission SEC. Obviously you can a negative balance on Robinhood if you are trading on margin.

If your Buy Call or Put is ITM In the Money.

How I Pick My Stocks Investing For Beginners Youtube Investing Finance Investing Investing In Stocks

5 Things Not To Do In The Robinhood App For Stock Trading By Jen Quraishi Phillips Medium

5 Things Not To Do In The Robinhood App For Stock Trading By Jen Quraishi Phillips Medium

4 Easy Ways To Go Broke Trading On Robinhood The Motley Fool

/GettyImages-932632502-b83a7730479048b4b68266b1f34a47c0.jpg)

What Happens When A Stock Broker Goes Bust

Robinhood Review The Best Way For Beginners To Trade Stock

Robinhood S Crypto Business Is The Tail That Wags The Doge Robinhood App Stock Trading Investing

The Tax Moves Day Traders Need To Make Now Day Trader Moving Day Capital Gains Tax

/images/2020/06/29/pensive-woman-looking-at-laptop-screen.jpeg)

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

Stock Leverage Guide What Is It Is It Worth It Timothy Sykes

I Owe Robinhood 30 000 The Real Risks Of Day Trading Youtube

Robinhood The High Price Of Free Stock Trades The Motley Fool

Wells Fargo Checks Wells Fargo Fargo Checks

Just Opened A Robinhood Account 3 Things You Should Know The Motley Fool

How To Become A Smart Spender All You Need To Know The Wealthy Alchemist Saving Money Money Mindset Quotes Money Saving Tips

How To Save For A House Mamafurfur Best Money Saving Tips Money Saving Challenge Ways To Save Money

Robinhood Ditches 3 Day Wait Fronts New Users 1000 To Buy Stocks Techcrunch

Robinhood Backlash What You Should Know About The Gamestop Stock Controversy Cnet